JAKARTA, POSKOTA.CO.ID - Hello there! Are you:

● An international student in Indonesia?

● An entrepreneur with overseas suppliers?

● Or an expatriate with a family back home?

If you fit into one of these categories, you’re likely familiar with remittance services.

Sending and receiving assets abroad is a regular part of your financial routine.

Which remittance services are you currently using? If you're still searching for the best

way to send assets abroad, consider using crypto. What are the advantages compared

to conventional services?

Let’s find out!

Send Assets Overseas: Conventional Services Vs. Crypto

Crypto is more than just an investment asset.

These days, the term crypto might sound familiar. Bitcoin, Ethereum, and Solana are

frequently discussed on podcasts and even during coffee shop conversations.

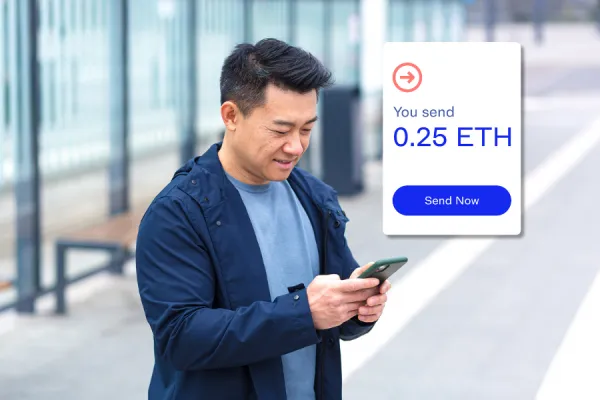

If you think crypto is only for investment, think again. You can use crypto for fast, cheap,

and flexible global transfers.

The following is an example of a case:

Mr. Andrew Smith, a 35-year-old US expatriate, has lived in Bali for ten years. He

regularly sends US$1,000 each month to his family in his hometown.

Let’s compare conventional services with crypto for sending assets abroad.

Send Assets to the US with Conventional Services

.jpg)